LQ Tokenomics and Utility

Dear Liqwid Community,

We are proud to announce February 2nd, 2023 will forever remain as the date Cardano’s first algorithmic lending and borrowing protocol launched on mainnet after nearly 2.5 years since inception. From project co-founders meeting each other on Ideascale during an early Project Catalyst funding round to helping decentralize the network through staking the ADA market supply to single SPOs, Liqwid is a Cardano native protocol through and through. With our mainnet beta launch complete our core team is excited to ship the final v1 components including Cardano native asset markets (e.g. community approved stablecoins), LiqwidDAO’s Agora instance and governance portal UI (LQ staking, Aquafarmer boost), protocol incentives and LQ rewards distribution. All of these workstreams will be completed and launched on mainnet this month, some as early as next week. Once fully implemented in the following weeks, Liqwid v1 mainnet beta will have equivalent functionality to AAVE or Compound v2 protocols in addition to liquid staking functionality for ADA lenders (qADA holders).

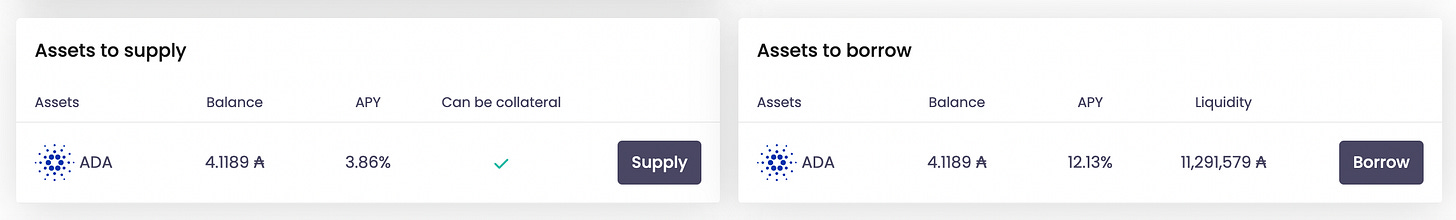

Our core team is so thankful for the support and excitement around the mainnet beta launch, the Liqwid ADA market supply currently has ~11.3m ADA in supplied liquidity and current supply and borrow APYs correspond to a ~40% market utilization. All the market actions are working in the UI, HW wallet support with eternl also works in the app UI. The qToken interest accrual mechanism, interest rate algorithm and liquid staking mechanisms are all working exactly as implemented (and audited).

We are actively processing feedback from the community’s request for UX improvements and responding to feedback on transaction errors experienced by users. To report app issues or transaction errors please visit the #app-issue-reporting channel in the Liqwid Community Discord server and enter a screenshot of the transaction error/issue experienced. Please note this is only a stopgap solution while we implement a proper issue ticketing system in our Discord.

Security and decentralization have always been the ultimate focus points of the core team. As such we prioritized testing and auditing of the Liqwid and Agora v1 smart contracts. The upcoming activation of our on-chain governance protocol, Agora will be the genesis event for a new era of DAO innovation on Cardano. We are humbled and pleased to see multiple Cardano teams already building on top of Agora including Summon, Clarity, SundaeSwap and others. The LiqwidDAO’s Agora instance will enable users to vote, stake and delegate their LQ directly in the app UI. Testing for the governance portal UI is near complete and will be added to the production app once the Agora off-chain developers complete final testing of DAO parameters and proposal effects.

The rest of this article is dedicated to recent discussions on LQ Tokenomics, token utility and LiqwidDAO governance.

Based on the broad community feedback to the initial LQ emissions schedule via the DEX liquidity incentives and Minswap CZI members of the Liqwid core team proposed to pause both incentive programs until a proposal with broad community consensus is passed. At the time of writing, and after 3 full days of voting the results are in favor of pausing.

Therefore, the Minswap CZI is cancelled, and any protocol owned liquidity bootstrapping and DEX incentive is cancelled until an on-chain community vote has passed successfully. The LQ allocated to these incentive programs are now added back to the LiqwidDAO treasury allocation according to the proposal’s outlined plan.

What is the Liqwid DAO Token?

LQ is the native asset for the Liqwid protocol used as the foundation of the protocol's decentralized community governance. The LQ token has a fixed supply of 21 million and was the first DeFi governance token minted on Cardano following the Mary hard fork which enabled minting of Cardano native assets and NFTs for the first time. The initial members of the LiqwidDAO received the first LQ distributions as part of the Discord Community Airdrop completed January 2022.

LQ Utility

In the coming weeks holders will be able to vote on protocol updates and earn staking rewards while using staked LQ as collateral. In the longer term LQ holders will unlock advanced governance properties as part of the Agora-Pro module.

LQ deposited in the Safety Pool (Liqwid’s insurance pool of staked LQ) can be used in proposal submission and on-chain voting processes including voting power delegation. As the native asset LQ is the reserve asset used as a risk management measure to protect protocol users.

In counterparty to this risk, LQ holders who stake in the Safety Pool receive a 5% APY staking reward, and in the future via a successfully passed community vote on the fee-switch (already implemented) a percentage of the interest paid by the borrowers may be distributed to LQ stakers on top of the staking reward. Finally, the LQ token can be used as collateral within Liqwid without leaving the Safety Pool.

LQ Tokenomics

With 75% of LQ token supply allocated for distribution to the community (starting with the Discord Community Airdrop completed in January 2022) the token allocations and distribution is one of the most equitable models for an advanced Cardano DeFi protocol.

*The Safety Pool refers to LQ Staking in Liqwid DAO’s Agora instance.

1. User Distribution (lending/borrowing incentives):

Incentives to lenders and borrowers will be distributed over 48 months and the allocation key will be based on the amount of interest accrued daily by the borrowers in each Liqwid market. Incentives will be divided equally between the suppliers and the borrowers in select Liqwid markets (ADA, community approved stablecoins), and the total LQ amount distributed per market will be controlled through a governance configurable multiplier (i.e., the incentives distributed for accruing $1 of supply/borrow will depend on the community voted multiplier parameter).

The activation and updates to the calculation of the protocol incentives or parameters will require community governance votes.

The core team is working on the calculations and logic for the User distribution system which is expected to be implemented around the end of this month or latest early March.

2. DAO Treasury:

These tokens are controlled by the DAO with the primary purpose of funding community driven projects and initiatives.

*In the event more complex transactions are required beyond a simple transfer a multi-signature wallet owned by the LiqwidDAO Association will be utilized.

Note: Any liquidity bootstrapping event or DEX incentive program has been postponed until the on-chain governance is fully activated. The allocation from these programs has been returned to the DAO Treasury allocation until a community governance vote is successfully executed.

3. Safety Pool (LQ Staking):

LQ holders can deposit their LQ in the Safety pool on Liqwid, which acts as an insurance layer for protocol users in the case of a Shortfall Event. The staked LQ will be used as a loss compensation tool in case of a Shortfall Event within the Liqwid money markets. A Shortfall Event occurs when there is a deficit impacting liquidity providers on the Liqwid protocol.

As counterparty for this responsibility, LQ staked in the Safety Pool allow their holders to:

Propose and vote with their LQ on community governance proposals (1 LQ = 1 vote)

Earn 5% per year (APY) on their LQ (staking reward)

Earn a variable yield as counterparty for the slashing risk, which is financed by the interests paid by borrowers per market

This “fee-switch” feature will be subject to an on-chain vote for activation and the staking feature will be activated shortly once the LiqwidDAO governance portal UI is launched.

The Aquafarmer boost (depending on its rarity and not cumulative) will be added to the total amount of LQ staked in the Safety Pool per user and will be activated with the staking feature for LQ deposited in the Safety Pool. Users will need to hold the Aquafarmer in their connected wallet they stake LQ from for the boost to be included. The rarest Aquafarmer will be used for wallets holding multiple Aquafarmers.

The core team is expecting to have completed all these features in the coming weeks by end of this month or beginning of March.

4. Airdrop:

Implemented in January 2022, where 1.5% of LQ token supply was distributed to the Liqwid Community Discord members.

5. Core Team, Advisors and Founders:

The tokens will be distributed over a linear 2-year vesting schedule which goes into affect starting at LiqwidDAO Agora instance and governance portal launch. At this time the core team will receive the remaining LQ in the first tranche (1 week of vested tokens were distributed after the completion of the airdrop in January 2022 equal to 50,000 LQ. The remaining 168,750 LQ representing the 1st month of vested tokens will be distributed at LiqwidDAO launch).

*Calculation for the core team allocation per monthly tranche:

21,000,000 total LQ token supply x 25% Core team allocation / 24 monthly tranches = 1.04% = 218,750 LQ.

As 50,000 LQ was already distributed, the remaining 3 weeks of vested tokens in the first month’s tranche will be 168,750 LQ (= 218,750 – 50,000).

With an airdrop of 315,000 LQ, the majority of the LQ tokens in circulation at the LiqwidDAO’s Agora launch will be in the hand of the community to ensure full decentralization.

Note: Liqwid core team completed a seed fundraising round in Q1 2022 to finance development costs and accelerate the delivery of the protocol’s v1 smart contracts. The vesting period for the private investors is 2 years linear with a 4-month cliff starting at mainnet beta launch (cliff starting 2nd February 2023).

Outlook:

In additional to the above-mentioned LQ tokenomics topics the core team is working on off-chain and infrastructure support for Cardano native asset markets. Multiple asset markets including cross margin borrowing feature is expected to be deployed on mainnet in February.

We are especially glad to see a diverse selection of stablecoins arriving in the Cardano ecosystem, which have been the lifeblood of DeFi liquidity protocols, and we are looking forward to listing them on Liqwid.

The core team will publish during the next weeks more information about essential topics for Liqwid, such as:

The Safety Pool: How does it work, and when can it be activated

The Risk Framework, which covers the parameters mechanisms per market and their configuration

User guides for completing market actions in the app

The LiqwidDAO on-chain voting process and an overview on the Agora on-chain governance module

Updates from the LiqwidDAO Association

Closing word:

By this time next month we expect to have completed all “tune-ups” and be fully driving the Liqwid protocol towards accelerating TVL growth on Cardano and be sure of this, we will not stop there. We have many ideas to expand our product offering within the DeFi and RealFi realms.

We have also witnessed the awakening of traditional finance for blockchain, and as stated in this study for “Institutional DeFi”, blockchain will power global bank’s back-office operations in the next five to 10 years. This sentence may have sounded silly a few years ago but is now making its path in the headlines of corporate banking conglomerates and financial media outlets.

With this in mind, we know that the burgeoning Cardano DeFi ecosystem will thrive, and has the potential to outclass its competitors in this time horizon. With this our Liqwid core team is excited to continue innovating on Cardano DAO and DeFi products alongside talented community developers while advocating for a more decentralized network.

- Liqwid Labs Core Team